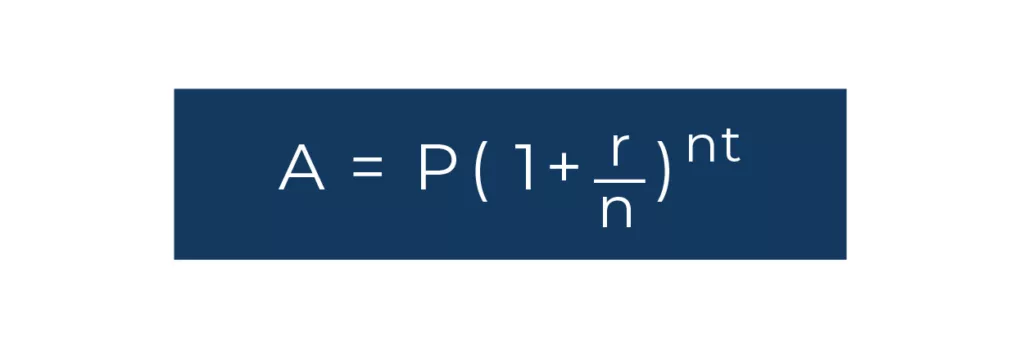

So we looked at the formula for compound interest (above) and the name became apparent. Literally. We could see the word spelled out in the variables: APPARENT.

Our original capital investors committed to investing on a long-term basis, with no time-sensitive demands to receive their capital back or to earn short-term cash returns. They understood that firms that deploy their resources with an eye toward the long term can have an edge over those that must meet short-term, quarterly targets set and reset for them by a group of outside analysts.

This long-term horizon is fundamental to Apparent and super-compounding. It has allowed us to invest in high-quality, long-term assets that deliver strong and accelerating returns, continually and exponentially growing over time. This snowballing growth is the definition of super-compounding, and the very foundation of Apparent.

Super-compounding relates not only to the assets and the capital we invest in deals; it extends to the capabilities of our company, our team, our people, our experience, and our expertise. The growth of those assets and the increase in value of those investments isn’t a linear process. We see every asset, every investment, as a living, breathing, organic enterprise that can appreciate in value over time. Really all that matters is what it becomes worth after it’s been given a chance to grow.

When we commit to building and cultivating our financial and human investments over the long run, we fortify the foundation that makes Apparent’s success possible and enables the amplification of our returns.